Donor Management System

At some point, and under specific circumstances, your charity might be faced with the need to refund a Contact for their offline Contribution (i.e., a gift not made through CanadaHelps.org). You can keep track of any refunds in your DMS by simply modifying the original Contribution. It'll then be up to you to decide the best way to credit your donor for the refunded amount.

This article will cover how to mark a Contribution as Refunded in the DMS by modifying its Contribution Status.

Considerations

- You can only change the Contribution Status for an offline Contribution (i.e., those Contributions whose Source is not CanadaHelps)

- If the offline Contribution you want to refund has already been tax receipted:

- Changing a Contribution Status to Refunded will automatically cancel the tax receipt associated with it

- Important: To be able to access the voided tax receipt (so you can send a copy to your donor), you'll want to make sure that you void the tax receipt before changing the Contribution Status (see below)

- Otherwise, even if you revert the Contribution Status from Refunded back to Completed, the original tax receipt will remain cancelled (but you won't be able to access a copy of it)

- If the Contribution you're looking to refund has not been tax receipted, feel free to head straight to the Refunding a Contribution section of this article

Voiding the Tax Receipt (if applicable)

As mentioned above, if you're looking to refund a Contribution for which you've already issued a tax receipt, you'll just want to make sure that you first void this tax receipt before changing the Contribution Status. That way, you'll be able to access a copy of the voided tax receipt (to send to your donor).

1. Visit the Contributions tab

2. Search for the Contribution you want to void the tax receipt for and select the Contribution Amount

Contribution amount

Contribution amount

3. On the next page, select Manage Receipt in the top-right

Manage Receipt

Manage Receipt

4. On the next screen, you'll see more details about the receipted Contribution.

5. Select Void Tax Receipt on the bottom-right (note: your Contact won’t be notified even if Email had previously been the Delivery Method).

Void Receipt

Void Receipt

6. You can then download the voided tax receipt (to send a copy to your donor) by selecting Print as the Delivery Method and then Complete.

Download the cancelled tax receipt to send to your donor

Download the cancelled tax receipt to send to your donor

Marking a Contribution as 'Refunded'

1. From the same Tax Receipt landing page where you've just voided the receipt, select the Contribution amount

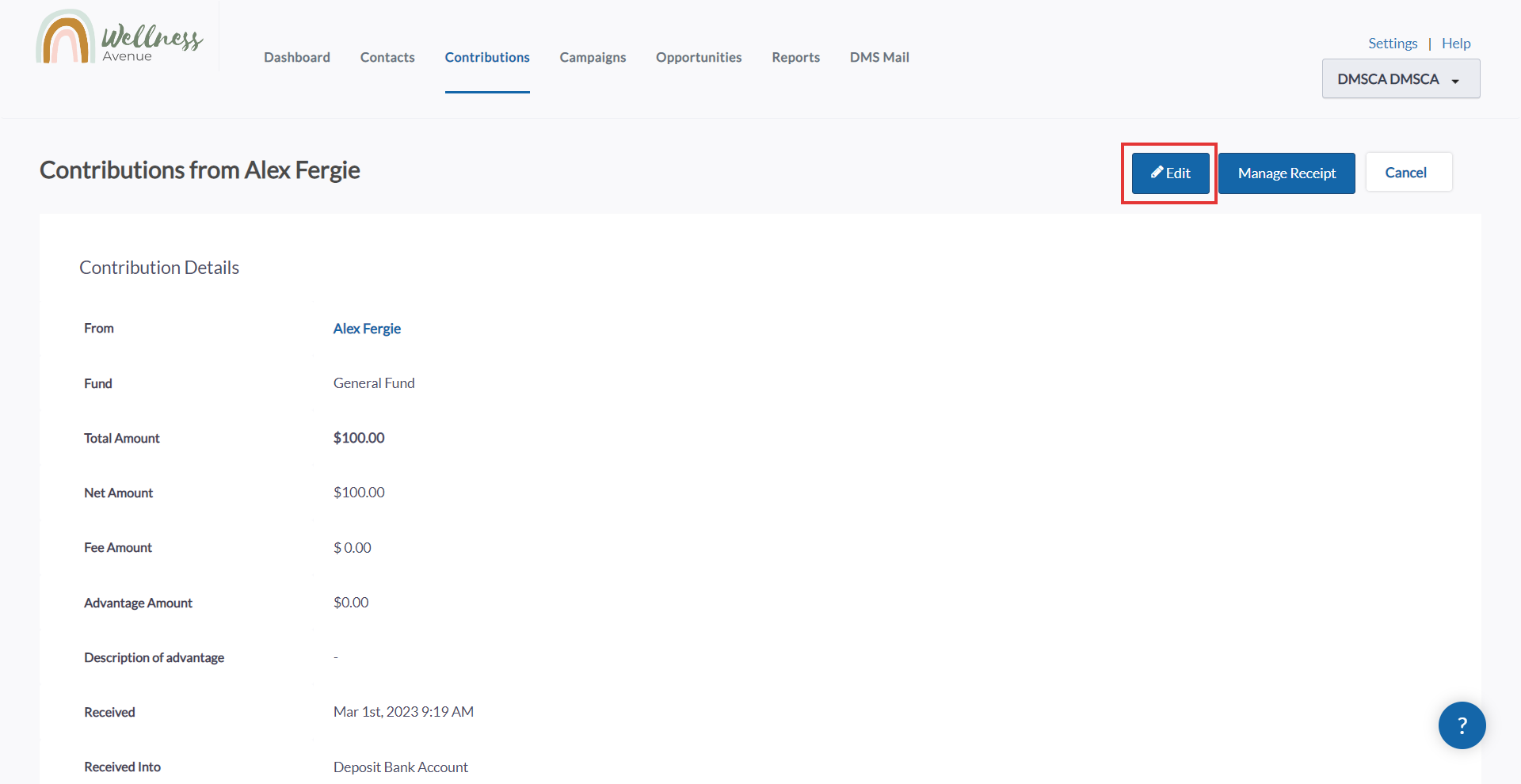

3. On the Contribution Details page of the Contribution whose receipt was just cancelled, select Edit on the top right-hand corner of the screen

Edit Contribution

Edit Contribution4. Under Contribution Status, change the status from Completed to Refunded, and click Save.

Contribution Status update: Refunded

Contribution Status update: Refunded

5. Once the Contribution Status has been changed to 'Refunded', back on the Contribution details page, you'll notice that the Contribution is no longer eligible for a tax receipt

Contribution status: Refunded

Contribution status: Refunded

What's Next?

Remember, because this was originally an offline Contribution (i.e., not made through CanadaHelps), it'll be up to you to decide how to credit your Contact for the Contribution amount (e.g., through cash, etransfer, cheque).